Buyers need to know how their numbers add up

Undoubtedly, buyers are well aware of the multitude of numbers involved in purchasing a home. If calculated proactively, the following four categories of required consideration will pay big dividends when buyers enter into the home sales transaction process. Ultimately, it stands to reason that buyers should know how much they are qualified to borrow before searching for the “perfect” property.

Undoubtedly, buyers are well aware of the multitude of numbers involved in purchasing a home. If calculated proactively, the following four categories of required consideration will pay big dividends when buyers enter into the home sales transaction process. Ultimately, it stands to reason that buyers should know how much they are qualified to borrow before searching for the “perfect” property.

Credit score and history

First things first. Wikipedia summarizes from varying sources, “A credit history is a record of a borrower’s responsible repayment of debts. A credit report is a record of the borrower’s credit history from a number of sources, including banks, credit card companies, collection agencies, and governments. A borrower’s credit score is the result of a mathematical algorithm applied to a credit report and other sources of information to predict future delinquency.”

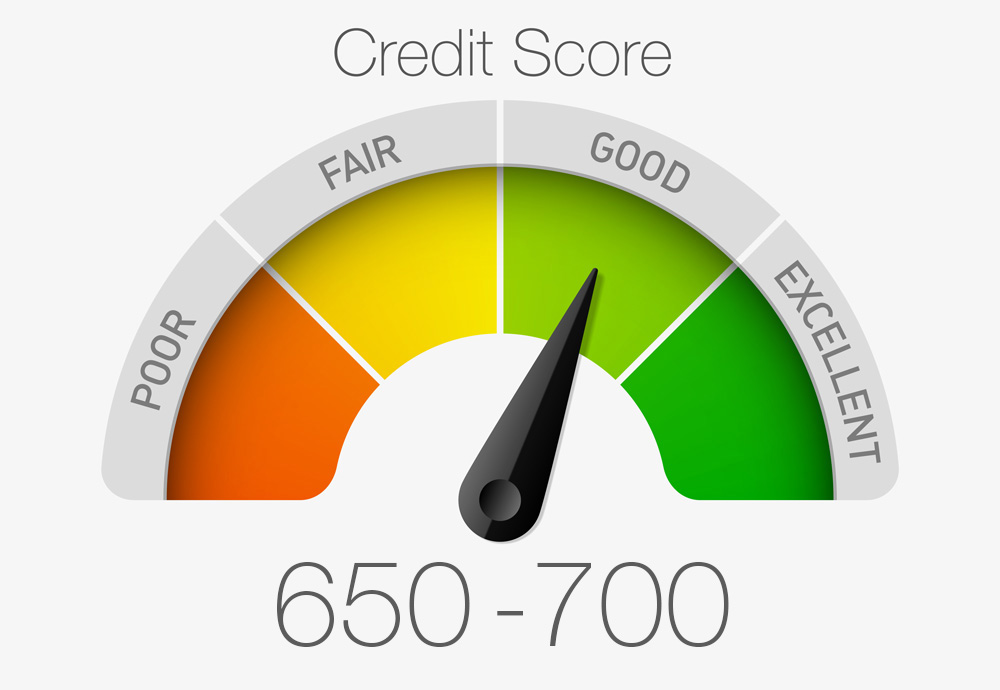

A buyer’s credit score is critical in the lender’s eyes. As noted above, this important number is a sophisticated gauge of the buyer’s ability and perceived reliability to repay the mortgage loan. Credit scores are determined by documented borrower credit history and include extensive documentation of a buyer’s repayment past.

Calculating a credit score

Wikipedia furthers notes, “Credit scores vary from one scoring model to another, but in general the FICO scoring system is the standard in U.S., Canada and other global areas. The factors are similar and may include: payment history (35% contribution on the FICO scale), debt (30% contribution on the FICO score), time in file (credit file age) (15% contribution on the FICO scale), account diversity (10% contribution on the FICO scale), and the search for a new credit (Credit inquiries) (10% contribution on the FICO scale).”

Obtaining a buyer’s credit score is very straightforward. According to most lender requirements, a buyer will need a score of 760 to 850 to secure the best borrowing rate. Anything less and the mortgage company will most likely demand a higher loan note rate.

Down payment

All of the above information regarding credit scores and histories could become even more important depending on the current strength of home buying programs in relation to the amount of a buyer’s down payment. As the old adages resound, “cash is king and money talks.” Obviously, the more down payment a buyer has, the less money that must be borrowed from a lender, and consequently, the less reliance there will be on the mortgage company to make or break the deal based on loan qualification alone. Ultimately, a buyer should work diligently to secure a 20% down payment to avoid the requirement to carry mortgage insurance.

Debt-to-income ratio

Next, lenders want to know the “net, net;” what amount of borrowing a buyer will be able to handle.

Of course, lenders expect to be repaid. They increase the probability of repayment by using age-old calculations of debt to income. This buyer-worthiness analysis includes: a housing ratio — which is the overall monthly housing loan payment (including insurance, applicable interest, required taxes, and PMI – property mortgage insurance) (if necessary). All of these amounts are divided by a buyer’s monthly income to arrive at a percentage. The general rule of accepted affordability is to keep this ratio below 28%.

Additionally, lenders will calculate a buyer’s total debt-to-income ratio, a calculation that determines how much of a buyer’s monthly income must address existing debt (i.e., credit card payments, car loans, or student loans). This ratio is determined by calculating total monthly debt payments divided by the total monthly household income. The widely-accepted rule of this calculation is to keep the ratio below 36%.

All in all

Summarily, a buyer must be able to prove the ability to repay or cover any and all financial requirements to successfully close a loan. Ever since the 2008 financial crisis – and the well documented home-purchasing debacle – lenders have tightened their buyer qualification demands. The more leverage a buyer has via credit worthiness, down payment, and/or favorable debt-to-income, the easier it will be to obtain an aggressive – and more affordable – loan repayment interest rate.

Doing the homework up front, up to and including obtaining a pre-qualification letter that includes a competitive loan amount from a lender, will clearly demonstrate a buyer’s seriousness – and perhaps more importantly, make an irrefutable statement of sincerity to any prospective seller.